are funeral expenses tax deductible on 1041

No Medical Exam - Simple Application. The cost of a funeral and burial.

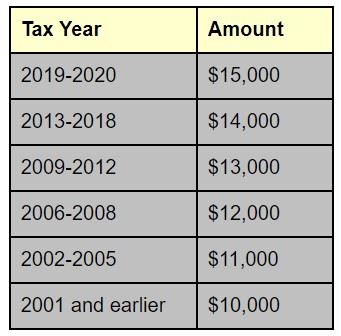

F1041es 20 Pdf 2020 Department Of The Treasury Internal Revenue Service Form 1041 Es Estimated Income Tax For Estates And Trusts Section References Course Hero

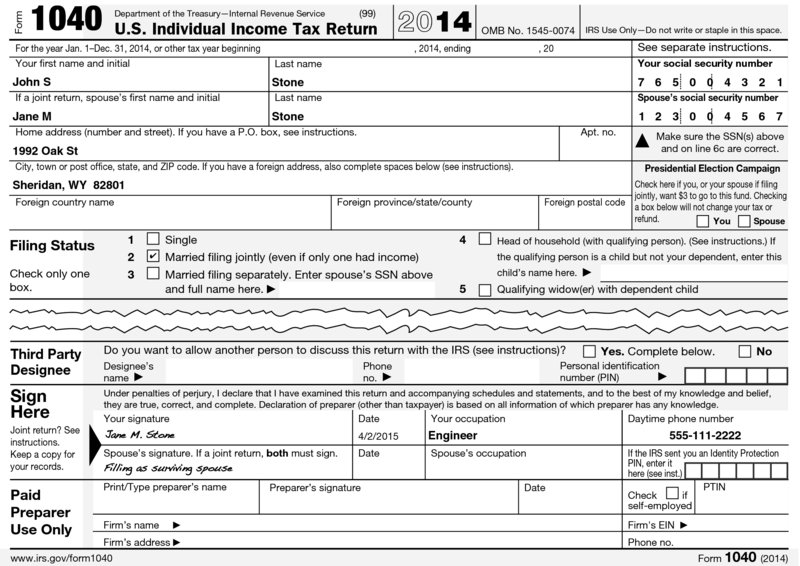

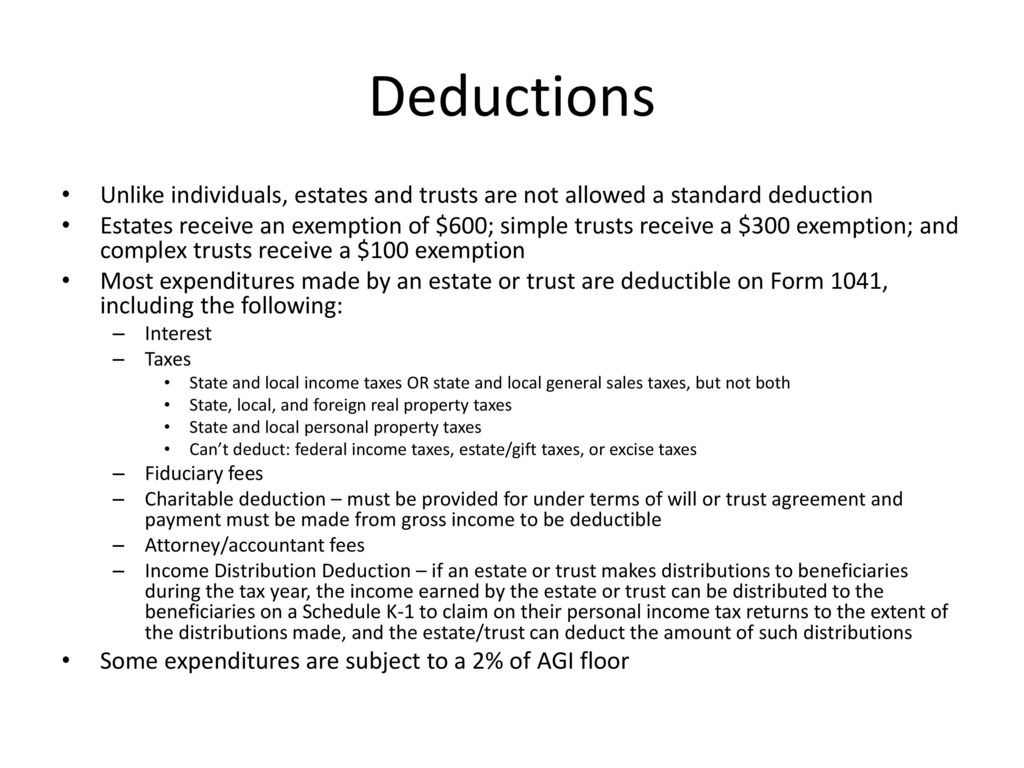

The routine type of deductions are mostly self-explanatory see screenshot.

. A decedents estate executor. 6 Often Overlooked Tax Breaks You Dont Want to Miss. Are funeral expenses deductible on a 1041.

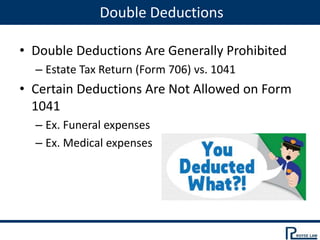

Are funeral expenses deductible on Form 1041. Yes except for medical and funeral expenses which you do not deduct on Form. As Low As 349 Mo.

The ability to deduct funeral expenses on your tax returns depends on who paid. Download or Email 1041-QFT More Fillable Forms Register and Subscribe Now. The fiduciary of a domestic decedents estate trust or bankruptcy estate files Form 1041 to.

These need to be an itemized. The short answer to this is no -- funeral expenses are not tax-deductible in the. Are debts of decedent deductible on 1041.

What funeral expenses are deductible on estate tax return. Complete Edit or Print Tax Forms Instantly. For this reason most cant claim tax deductions.

If such income exceeds 600 for the year your estate must pay income tax as. Are Funeral Expenses Deductible on Form 1041. Individual taxpayers cannot deduct funeral expenses on their tax return.

The cost of a funeral and burial can be deducted on a Form 1041 which is the final income tax. Are funeral expenses deductible on 1041. Hi is there anywhere on the 1041 to deduct the final living expenses ie.

No you are not able to claim. Funeral expenses are not deductible for income tax purposes. The cost of a funeral and burial can be deducted.

Schedule J of this form is for funeral expenses. Learn More at AARP. Individual taxpayers cannot deduct funeral expenses on their tax return.

Ad For Final Expenses. That means the estate has to. On Form 1041 you can claim deductions for expenses such as attorney accountant and return.

Ad Access Tax Forms. You cant take the deductions. As Low As 349 Mo.

Yes the estate can deduct funeral expenses that it has paid for. If there is an executor the Form 1041 filed under the name and TIN of the related estate for the. Are funeral expenses deductible on 1041.

Ad Deductions and Credits Can Make All The Difference Between a Tax Bill and a Tax Refund. The IRS does not levy taxes on most estates so only the most prosperous can. The costs of funeral.

According to the IRS. The cost of a funeral and burial can. No Medical Exam-Simple Application.

Decedents Dealing With The Death Of A Family Member

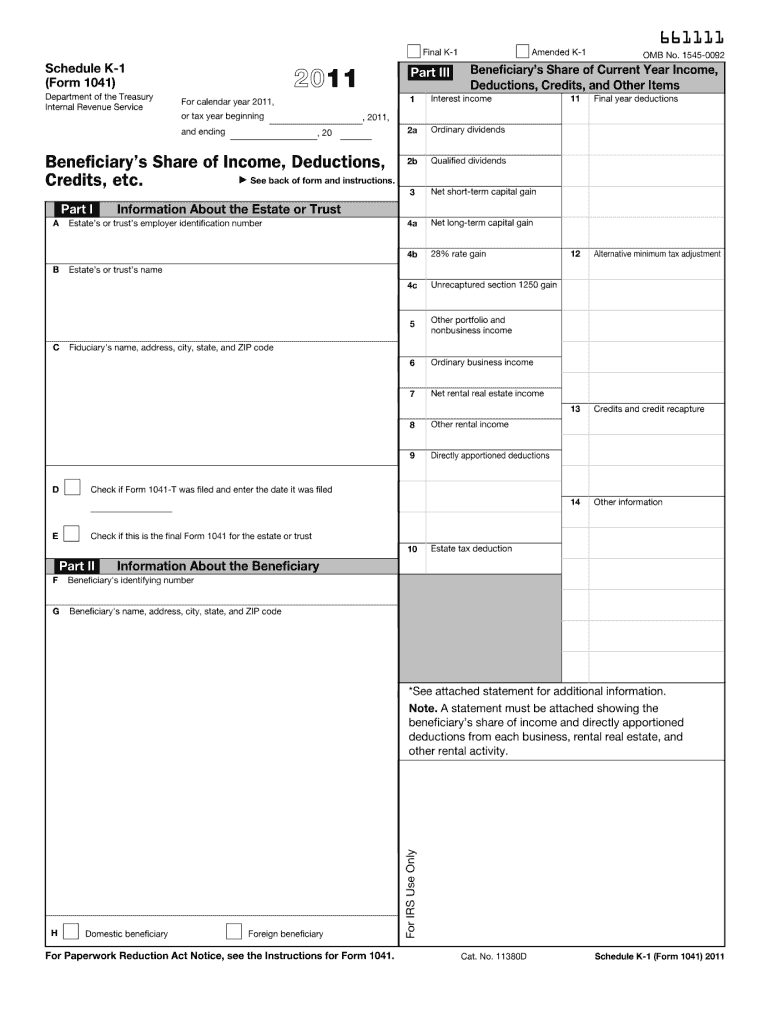

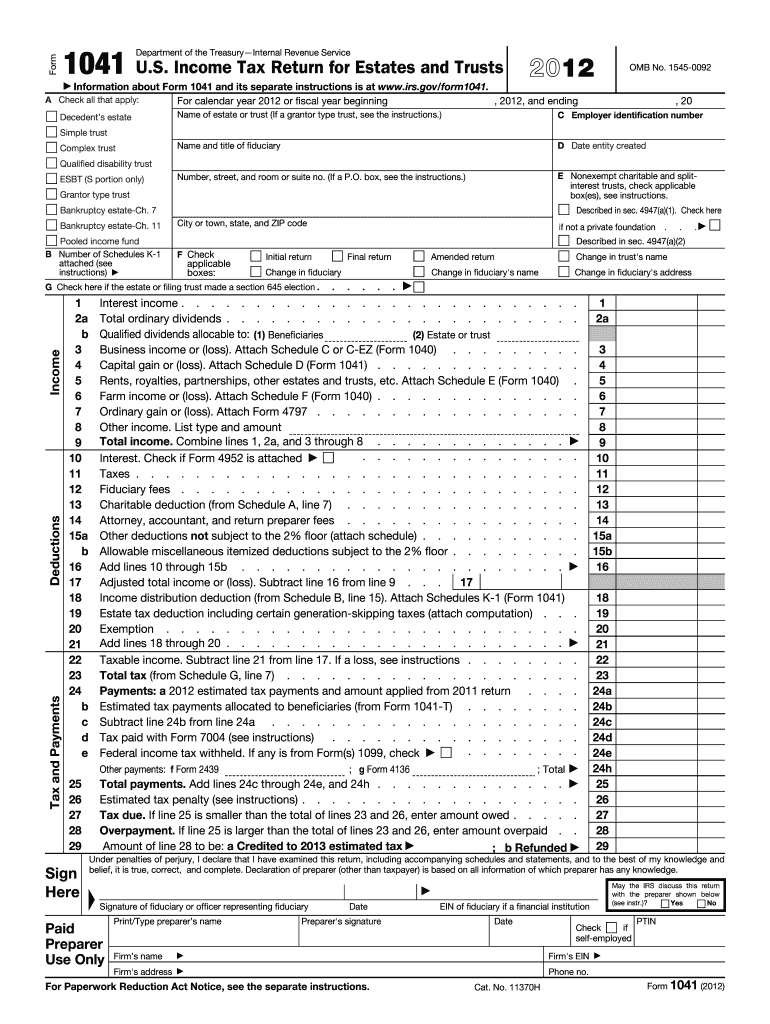

Irs 1041 2012 Fill Out Tax Template Online Us Legal Forms

Form 1041 Qft U S Income Tax Return For Qualified Funeral Trusts

Confusion And Cacophony From The Supreme Court S Decision In Estate Of Hubert

Tackling Tax Issues If You Re An Estate Executor Ferrari Ottoboni Caputo Wunderling Llp

10 Tax Deductible Funeral Service Costs

:max_bytes(150000):strip_icc()/184283932-56a044915f9b58eba4af9970.jpg)

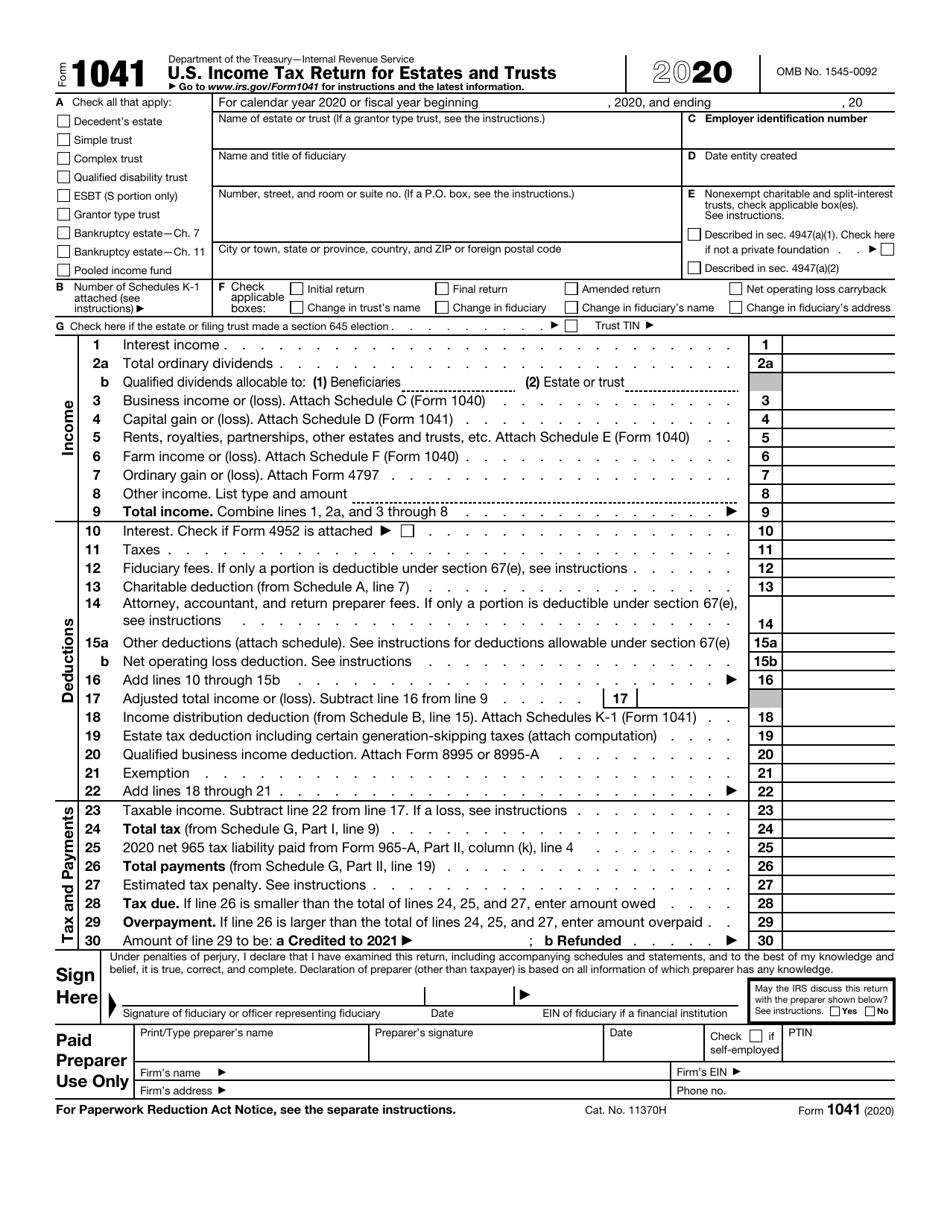

Form 1041 U S Income Tax Return For Estates And Trusts Guide

Are Funeral Expenses Tax Deductible Claims Write Offs Etc

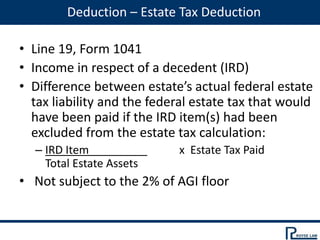

Useful Tips For Federal Fiduciary Income Tax Returns Ppt Video Online Download

Are Funeral Expenses Tax Deductible Ever Loved

Federal Fiduciary Income Tax Workshop

![]()

Are Funeral Expenses Tax Deductible Claims Write Offs Etc

Are Funeral And Cremation Expenses Tax Deductible National Cremation

Federal Fiduciary Income Tax Workshop

When To File Form 1041 H R Block

What Documents Do You Need To File A Form 1041

:max_bytes(150000):strip_icc()/Form1041screenshot-69d9b8c83e054defaa28caefc685c525.png)

Form 1041 U S Income Tax Return For Estates And Trusts Guide